The Recent Rise of Bitcoin

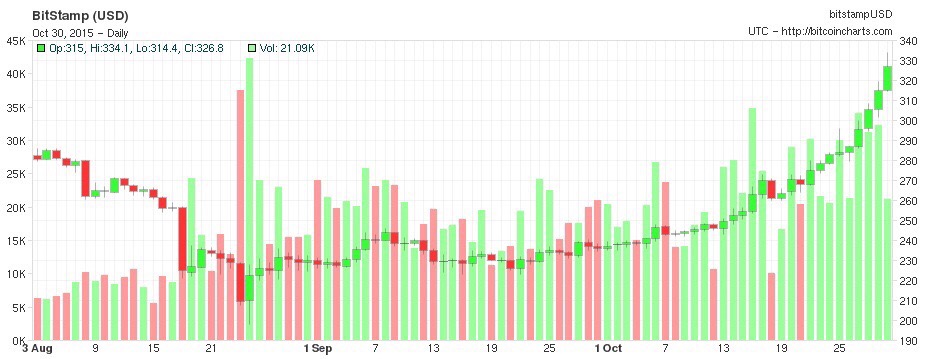

Bitcoin is making another run for it. The price is rapidly reaching new highs this year. Currently 1 Bitcoin is worth over $309. The price has reached these heights twice before this year – previously in March and July. Will this continue? Let’s have a look at a few reasons and factors that may be influencing this.

Support & Resistance Levels

This year the price of Bitcoin has settled into a steady pattern. It keeps bouncing around in the corridor between the levels of around $200 and $300. Although the price quickly dropped down to nearly $150 at the beginning of this year the recurring lows this year have stayed around the $200 mark. Today we have reached the level of $309 again. From this we could speculate that the top has been reached again and we should be seeing another drop very soon. There is another middle support and resistance level in the middle that also controls the price a bit at $250. I am interested to see what happens in the next few days as this could be a new breakout and we’ve yet to see where the next level of resistance is. This might potentially be the beginning of a new rise of Bitcoin.

Update! As I was writing this article yesterday Bitcoin has since done another run – the price reached just over $335 last night. I reckon the rise of Bitcoin price will continue and the next level of support could be at $350.

Technical Indicators

This is where things might get a bit boring for a lot of you but when talking about the price and trying to speculate we should look a bit more at what the technical indicators are saying. Currently the 14 day RSI (Relative Strength Index) is at 85.21 and Bollinger Width at 74.87. These levels are extremely high and are essentially screaming of a bounce back and reversal of the trend or the complete opposite.However if we look at the MACD(Moving Average Convergence Divergence) is not showing any signs of the rise of Bitcoin slowing down. I am contradicting myself here, I know. Right now I will be keeping hold of my coins.

EU VAT Ruling

Another massive factor affecting the rise of the Bitcoin price is the positive EU VAT ruling at the end of last week. The Court of Justice of the European Union ruled that Bitcoin is exempt from VAT just like the exchange of banknotes and coins. Bitcoin should be looked at as a currency rather than a commodity and should be treated as a means of payment, and as such were protected under the EU VAT directive. You can read about the full details of the ruling here.

Rise of Bitcoin – Will it Continue?

Why is the EU ruling having such a positive affect ? Because until the 22nd of October a lot of EU countries were still effectively slowing down the use and adoption of Bitcoin. Now businesses that until now wanted to accept Bitcoin for their services but were penalised with tax in their country can freely do so now. Also it can give a positive kick for a lot of new startups that were thinking of doing something in the crypto world but were cautious because of the stand their country had on it. The more businesses and people use Bitcoin the higher the price will climb. Just like with any other price or commodity – more demand will put the price up. On top of this we have seen a growth in venture capital investments this year. For example just a little while back, in September IBM announced that they will be investing into Bitcoin and development in blockchain-tech.

Trading and investing into any currencies and commodities is risky. With Bitcoin you need to keep in mind the volatility of the price. The price moves very quickly so this is something you need to be aware. I for one love trading Bitcoin exactly because of this – if you make the right decisions your profits can be great even with not a very big starting capital. You can get on the Bitcoin bandwagon with HitBTC here.

Disclaimer

I must point out though that the speculation of the price and its future movement is my personal opinion – although I do have a lot of experience in trading and cryptocurrencies I urge everyone to make an educated decision and never trade with money you cannot afford to lose.