Risk Aversion & Loss Aversion

In trading and economics people tend to show two types of behaviours. These two are risk aversion and loss aversion. Risk aversion is when you are not reluctant of taking high risks for a reward. Loss aversion is rather the opposite, this is when you start taking higher risks to try and prevent losses.

I am really interested in this topic and I started looking into it when I first started trading and suffered some losses. The human behaviour is very different when money comes into play. There have been many studies on this and it is truly fascinating. Daniel Kahneman and Amos Tversky’s Nobel Winning findings are what interest me the most. They explain how these behaviours are almost primal instincts and the psychology of humans trading is something rather peculiar. It can work against you, however if you are aware of these behavioral patterns you can resist it and make rational decisions.

Risk Aversion

Firstly let’s explain what risk aversion is. This is how Wikipedia defines it:

In economics and finance, risk aversion is the behavior of humans (especially consumers and investors), when exposed to uncertainty, to attempt to reduce that uncertainty. It is the reluctance of a person to accept a bargain with an uncertain payoff rather than another bargain with a more certain, but possibly lower, expected payoff. For example, a risk-averse investor might choose to put his or her money into a bank account with a low but guaranteed interest rate, rather than into a stock that may have high expected returns, but also involves a chance of losing value.

A trader with risk aversion will by nature prefer situations with a lower return however also with a lower risk. Therefore the intention is keeping the losses minimal. This is a great and safe trait to have however risk averse traders might have lower profits than someone willing to take high risk-high payoff investments. On the other hand a risk averse trader will be less likely to incur high losses therefore might end up with higher profits than a trader who loves risky situations.

Being risk averse doesn’t necessarily mean being scared or somehow insecure. It is more about about having the need or want to preserve the state the person is currently in. There’s normally no detriment to the trader by being more risk averse. It can be viewed as the safe and steady approach to investing. Yes, this attitude might not make you a millionaire but it certainly won’t make you lose millions either. However this is not to say that people who are more risk averse won’t also act in ways that is considered to be loss averse. For example when a trade or investment is going completely the other way for a normally very cautious person, you might start seeing some risky behaviour instead. We as a species have very complex behavioral patterns and I don’t think you can class people as only being one or the other.

Loss Aversion

And here is a definition of Loss aversion from Wikipedia.

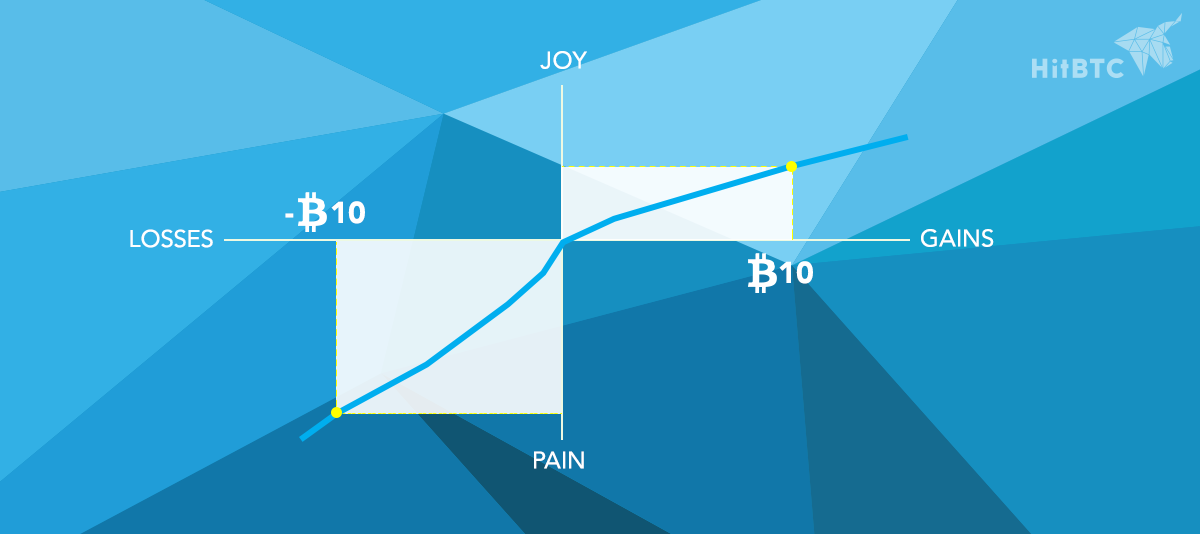

In economics and decision theory, loss aversion refers to people’s tendency to strongly prefer avoiding losses to acquiring gains. Most studies suggest that losses are twice as powerful, psychologically, as gains.

Loss aversion brings out some peculiar behaviour when trading. What happens is we let our emotional attachment to not losing override the logic of cutting our losses short. To put this into context when a trade is going significantly south for you the instinct with loss aversion is not to get out but to keep trading with the hope of there being a reversal and making your losses back. This is rather illogical as you wouldn’t behave in this way say for example if your sink was leaking. To avoid the damage, surely you would turn the water off not wait in hope of the water suddenly to start pouring back into the tap. This is a rather blunt comparison but does the trick.

There is a great documentary by BBC called How You Really Make Decisions which focuses on Daniel Kahneman’s studies. I highly recommend watching this if you are in the trading game or even if you are not. Horizon documentaries are always really informative and make you see things from a different perspective. Let’s give an example from the documentary to explain loss aversion a bit more:

They conducted a test in the documentary. A group of people were given a decision – they were offered a £5 note or the option of tossing a coin to receive £20 or nothing. Most of them chose the risk free offering of £5. Another group was given £20 note and a decision to give £15 back and keep the £5 risk free or to toss a coin to keep the £20 or lose it all. Most people in that group chose to toss the coin which is rather strange as both of them were given the same risk free option of receiving £5. Scientists have also conducted a similar study on monkeys, introducing them to money and giving them the option of purchasing fruit. The monkeys in the experiment also showed signs of being loss averse.

If loss aversion is something that we have developed through hundreds of millions of years of evolution, can this behaviour really be changed? And should it change? I don’t think you can get rid of something that has been sort of a survival function. But you can start to analyze your behaviour and thoughts. When you understand what is happening you can adjust your actions – take a breath and get out of the trade. And this of course is precisely what stop-loss order is for.

Can I Beat it?

As I mentioned above you probably cannot completely switch off these primal instincts and behavioural patterns but you can learn how to control it. To be able to trade successfully you must set yourself some strict rules. Setting daily profit targets and loss limits is a very good idea. A lot of the times the greatest losses occur at the end of a really good day. So this is why it is reasonable to not get too greedy and quit whilst you’re still ahead.

Regarding loss limits – this is exactly to tackle with loss aversion. You might find yourself in a position when you are not having a great day and all of your investments suddenly start going south and making a loss. In this instance it is best to get out not to wait for the trend to turn because as you are probably aware a downtrend and an uptrend do not normally change course in the matter of hours. Also when trading Bitcoin you need to be cautious as the price is still very volatile. This can give you awesome profits, however it may also go the other way, so you need strong nerves for trading it.

What you can do is to read up more about trading psychology. I promise you, the more you know, the better you’ll perform. And it is almost certainly an interesting read as well. Having a bit more knowledge certainly won’t do you any harm. On top of this start monitoring your thoughts, feelings and actions whilst trading. No one else knows you better than yourself. You might also try arbitrage – this takes advantage of different prices on different platforms and minimizes your risks. Another great tool is to practice your strategies regularly on a demo account. You will always have free demo access on HitBTC to help you better your strategies and learn how to be a top trader.