Bitcoin Market Analysis: September 22-28

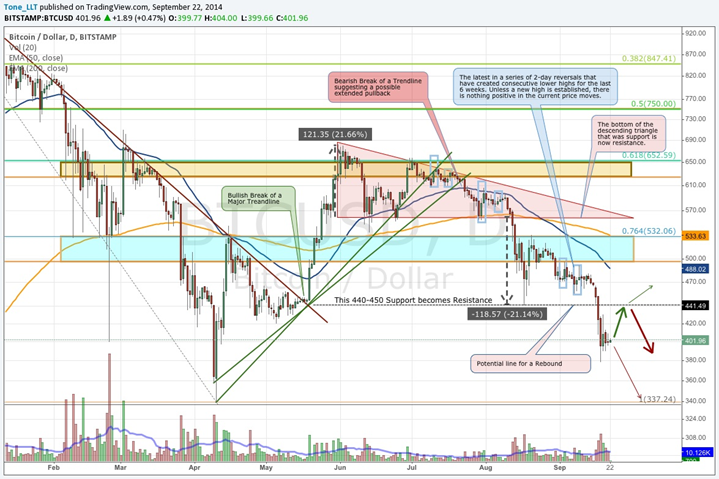

Last week’s report suggested continued downward pressure on prices and the expectation was that a fall down to $440 was perfectly reasonable. It was also suggested that if $440 does not hold price up, there was open air down to the $340-380 zone and that is exactly where the price turned around, the very top of that zone.

Now the situation is slightly different. There was a lot of news this past week and none of it seems to be bringing out more users willing to hold onto the Bitcoins and use them in commerce. Speculation raged from people liquidating Bitcoins to purchase Alibaba stock to suggesting that people in china are trying to crash the price on purpose. None of that appears to be credible, but a critical aspect was the banking relationships in the Isle of Man. This deep dependence to the legacy banking system will continue to play some havoc with the price so watch this type of news carefully. The NO vote out of Scotland is a bad sign for those looking for independence. Extrapolating the idea that people would rather be ruled or controlled by other is also not a good sign for Bitcoin’s future because it requires a great deal of independence to become your own bank and be fully responsible for your own money.

The general mood in the Bitcoin Ecosystem remains pessimistic even though the number of startups and companies willing to have employees work for peanuts because they believe that this technology is the future remains high. This is a good sign for Bitcoin price longer term but in the intermediate term lower prices are unfortunately still very likely.

The Month Ahead

The prices have dropped pretty far over the last two months. The next critical area of support that needs to hold is the $340 level, which would match this year’s low reached back April. It would be perfectly reasonable for the price to reverse from here permanently, but until we see some Bullish signs the bigger trend is still to the downside. We will watch the $340-350 zone with care and even if the price does rebound in the short term we are looking at that downside to hit by end of October. Thoughts of a reversal would begin with a higher high and one is nowhere in sight. There is a lot of resistance overhead starting with the breakdown area of $440-450, then $500, $530, $560 (base of the descending triangle), $630, $650 and $750.

The Week Ahead

The Intraday chart is starting to show some signs of life. Even though we are intermediate term Bearish, we will take a chance and suggest a high possibility that prices are due for a short term reversal. The RSI has been a great guide since the start of September and has consistently moved from oversold to overbought conditions. Watch the RSI and see if it continues on this current upward trend. Use yesterdays low of $390 as a guide, if the falls bellow it we will most likely continue and make new lows. If $390 can hold over the next day or two we will probably come back to the upside and test the breakdown area of $440-450.

Conclusion

We are looking for the test of the $440-450 zone. Watch the RSI in combination with the price. We are still overall bearish so a bounce back to those levels might be a good time to re-establish short or cash positions. Let the price guide you and see what happens after it reaches those levels. As for the potential downside, a new short term low is now established around $390, a fall below these levels is most likely going to bring about new lows down into the mid 300’s.

Reference Point: Monday Sep 22 10:30 pm ET, HitBTC Price $402

About the author

Tone Vays is a 10 year veteran of Wall Street working for the likes of JP Morgan Chase and Bear Sterns within their Asset Management divisions. Trading experience includes Equities, Options, Futures and more recently Crypto-Currencies. He is a Bitcoin believer who frequently helps run the live exchange (Satoshi Square) at the NYC Bitcoin Center and more recently started speaking at Bitcoin Conferences worldwide. He also runs his own personal blog called LibertyLifeTrail.