All You Need to Know About Perpetual Crypto Futures

Having launched in 2017, crypto futures are still a relatively new product on the market. In a trader’s portfolio, they can help manage risks, balance price fluctuations, or serve as an additional tool for gaining profit. Besides, crypto futures would also work for those who don’t particularly want to deal with digital assets directly, as they are often cash-settled.

Initially, Chicago Board of Options Exchange (CBOE) and Chicago Mercantile Exchange (CME) were the first two marketplaces that allowed its users to trade Bitcoin futures. At the moment, a wide range of platforms allows buying and selling Bitcoin futures, and some have also launched Ethereum futures trade.

What Crypto Futures Are and How They Work

Crypto futures are financial tools that allow traders and investors to buy and sell a specific amount of digital assets, namely Bitcoin and Ethereum, on a specific date at a particular price. When this date comes, the person who purchased a futures contract should seal the deal, regardless of the asset’s current price.

Let’s say it’s June 1, and you’re entering an agreement to buy BTC on September 30 for $25,000. When the time comes, even if Bitcoin’s market price is $40,000, the counterparty is required to sell it for the pre-agreed price. Alternatively, a trader can agree to sell a certain amount of coins for the pre-agreed price.

– Long position stands for the process of buying an asset at X price on Y date.

– Short position stands for the process of selling an asset at X price on Y date.

While some investors use futures for price speculation, others focus on locking in the asset’s price and protecting themselves against volatility.

Perpetual Futures

Unlike classic futures that have an expiration date, perpetual futures can be held by traders indefinitely. A funding mechanism helps with linking the price of the contract to the base asset price. The mechanism sets the funding interest rate based on two factors: premium index and interest rate

Price is higher than the base asset price

If the futures price surpasses the base asset price, traders who entered long positions pay a percentage, while short positions’ traders receive the equivalent of this percentage. The purpose of this mechanism is to encourage traders to close and open positions less frequently, so the futures price won’t be constantly increasing. Moreover, traders will potentially focus on less profitable short positions to cover the losses.

Price is lower than the base asset price

If the futures price ends up being higher than the base asset price, the opposite happens: traders in short positions are the ones to pay the funding and long positions’ traders get the profit. This way, traders will buy more and sell less, moving the price to the base asset price.

How to Start Trading Perpetual Crypto Futures

What is the difference between futures trading and regular cryptocurrency trading? First, with crypto futures, you don’t necessarily need to deal with crypto whatsoever. All the settlements are done with cash. However, it does depend on which platform you are using for trading. Secondly, as opposed to cryptocurrency trading that only offers a single way to make a profit, Bitcoin futures are slightly more diverse.

Basically, when you expect Bitcoin price to go up, you go long or buy a futures contract. And also, the other way around, when you expect that Bitcoin price is going to fall, you go short or sell the futures contract.

You can use futures for hedging and risk management, as well as leverage your positions, depending on the exchange.

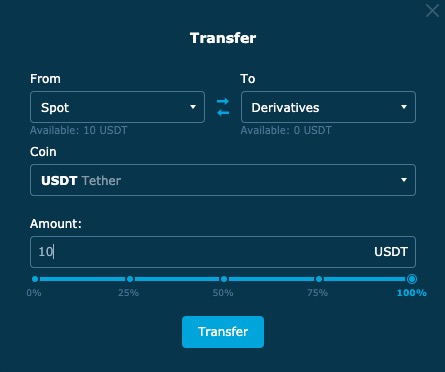

On HitBTC, users can buy or sell perpetual futures contracts. Before trading, you should deposit currency on the Derivatives account: open the Account page, press Transfer, select an account to transfer From (Spot or Wallet), and select the Derivatives account in the To drop-down menu. Enter the desired amount of collateral (margin) and press the Transfer button

To open a position, you can open the Derivatives page and make sure you’ve got USDT or other crypto on your account.

Here are a few further steps you need to take:

1. Go to the Futures tab, all available contracts are visible in the Contracts widget

2. Assign the currency amount, which will act as the collateral for this contract

3. Create a Long or Short order

4. The newly created contract is now visible in the My orders and trades widget

Futures contracts are settled daily so that your profits or loss is deducted or added to your balance at the end of each day. There is no commission to maintain the futures position, only the fixed taker (0.05%) and maker (0.02%) fees.

The user can place both the margin (on the Margin tab) and futures (on the Futures tab) positions. These are two different markets. Each instrument uses an isolated margin. Isolated Margin mode allows traders to manage their risks. If a trader’s position is liquidated in Isolated Margin mode, instead of their entire margin balance, only the Isolated Margin balance gets liquidated – unlike the Cross Margin mode, where the entire margin balance is shared across open positions to avoid liquidation. Our platform futures do not use Cross Margin.

Exiting Tips

Another thing you need to know before jumping into the world of futures trading is that it is possible to exit your contract.

There are two ways to do so: offsetting, and rollovers.

One of the most popular ways to exit a contract is offsetting – the process of entering another futures contract that features the same size and value. This way, the current obligations reset to zero and balance out.

Alternatively, one can practice rollovers, which is the same as offsetting, only with an extended contract end date.

Additional info

- You can trade several Bitcoin futures contracts at a time

- Experienced traders with a larger portfolio can hedge the risk of price fluctuations by entering the contract with an opposite position

- Bitcoin futures and stocks trading is not too similar, so previous experience with stock trading will not necessarily be helpful

Closing Thoughts

Trading cryptocurrency futures requires specific market behavior knowledge, following news and predictions, and staying self-aware. However, for experienced traders and investors, crypto futures can help balance their portfolio, lower risks, and in the best-case scenario, make a profit. Moreover, crypto futures add liquidity and attract more institutional investors to the market.